wichita ks sales tax rate 2019

Sales Tax Breakdown. Odometer is 21398 miles below market average.

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

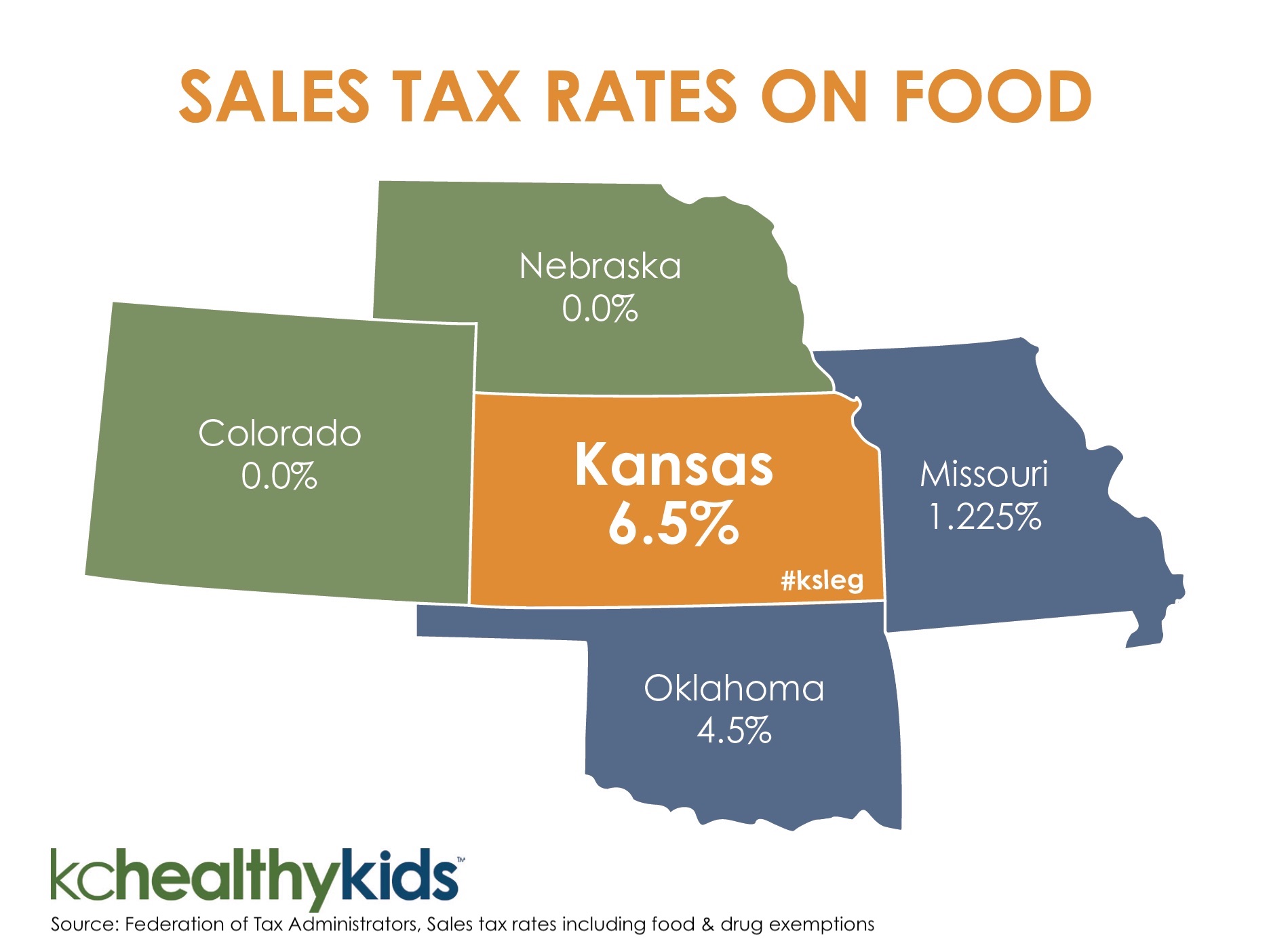

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Scriptions are 80 Kansas residents must include applicable state and local sales tax.

. Broadway Avenue as well as 212 221 and 223 E. Did South Dakota v. Wichita collects the maximum legal local sales tax.

Rate variation The 67206s tax rate may change depending of the type of purchase. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Periodicals postage paid at Topeka Kansas.

Select the Kansas city from the list of cities starting with A below to see its current sales tax rate. Kansas KS Sales Tax Rates by City A The state sales tax rate in Kansasis 6500. The County sales tax rate is 1.

There is no applicable city tax or special tax. Kansas has recent rate changesThu Jul 01 2021. 1928 CityHighway MPG Awards.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The rates listed below include the state sales tax rate of 65. Research the used 2019 Chevrolet Blazer for sale in Wichita KS near Derby.

The Kansas sales tax rate is currently 65. Burghart is a graduate of the University of Kansas. You can print a 75 sales tax table here.

These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates. Sales Tax State Local Sales Tax on Food. Average Sales Tax With Local.

Real property tax on median home. In 2019 it was 32721 based on the Sedgwick County Clerk. 4 rows Rate.

Used 2019 Chevrolet Colorado 4WD LT for sale in Wichita KS. Single copies if available may be purchased for 2. The 2018 United States Supreme Court decision in South Dakota v.

Wayfair Inc affect Kansas. Douglas AvenueIt also includes the City owned Chester Lewis Reflection Square Park and parking lot at William and Broadway. New sales and use tax rates take effect in the following cities counties and special jurisdictions on July 1 2019.

Send change of address form to Kansas Register Secretary of State 1st Floor Memorial Hall 120 SW 10th Ave Topeka KS 66612-1594. The 67206 Wichita Kansas general sales tax rate is 75. Call or visit our used car dealership for more details.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. The combined rate used in this calculator 75 is the result of the Kansas state rate 65 the 67206s county rate 1. Vehicle Property Tax Estimator.

The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. Wichita KS 67218 Email Sedgwick County Tag Office.

There is no applicable city tax or special tax. The rate may also vary for the same zip code depending of the city and street address. For tax rates in other cities see Kansas sales taxes by city and county.

Has impacted many state nexus laws and sales tax collection requirements. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. At that time you may either pay cash for the assessment or let it automatically be in the Citys next bond sale spread over 15 or 20 years at a relatively low interest rate. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

With local taxes the total sales tax rate is between 6500 and 10500. Ad Find Out Sales Tax Rates For Free. Call or visit our used car dealership for more details.

The following November the first assessment will be on your tax statement listed as a special tax and will be due along with your property tax. Research the used 2019 GMC Sierra 1500 for sale in Wichita KS near Derby. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

Buildings at 105 and 124 S. 638 rows Kansas Sales Tax. There are also local taxes up to 1 which will vary depending on region.

You can print a 75 sales tax table here. Thats an increase of 1431 mills or 457 percent since 1994. 3 lower than the maximum sales tax in KS.

Fast Easy Tax Solutions. Kansas sales tax changes effective July 1 2019. This used Chevrolet car is priced at 39160 and available for a test drive at Mel Hambelton Ford Inc.

The Wichita sales tax rate is 0. We have five new car locations and a dedicated sales staff to help you at any of them so come see what a difference a dealership can make.

Kansas Has Nation S Highest Rural Property Tax 2019 Green Book Kansas Policy Institute

Kansas Is One Of The Least Tax Friendly States In The Us Kake

Kansas Sales Tax Update Wayfair Safe Harbor Wichita Cpa

Kansas Has Nation S Highest Rural Property Tax 2019 Green Book Kansas Policy Institute

Institute For Policy Social Research

Sales Tax On Cars And Vehicles In Kansas

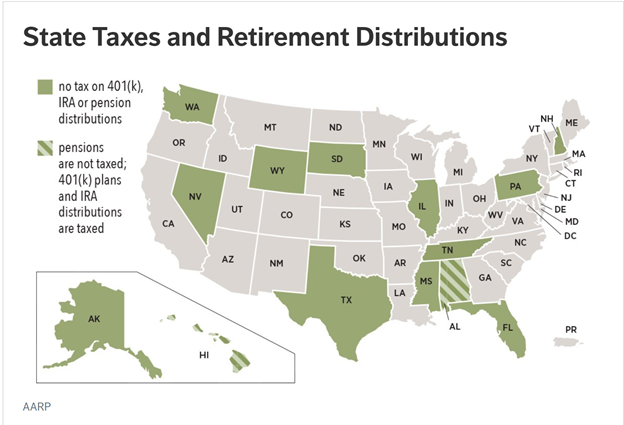

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute